SCGP announced its operating results for 2023, reporting a revenue from sales of Baht 129,398 million and a profit for the year of Baht 5,248 million. This achievement was attributed to the enhanced cost management efficiency and the strengthened network of recovered paper sources. SCGP highlighted a positive trend in packaging industry for 2024, driven by a boost in tourism and rebound in exports while inflation rates and interest rates are projected to decline. Laying out its plan for 2024 with strategic approach to drive revenue and profit, setting sales target of Baht 150,000 million.

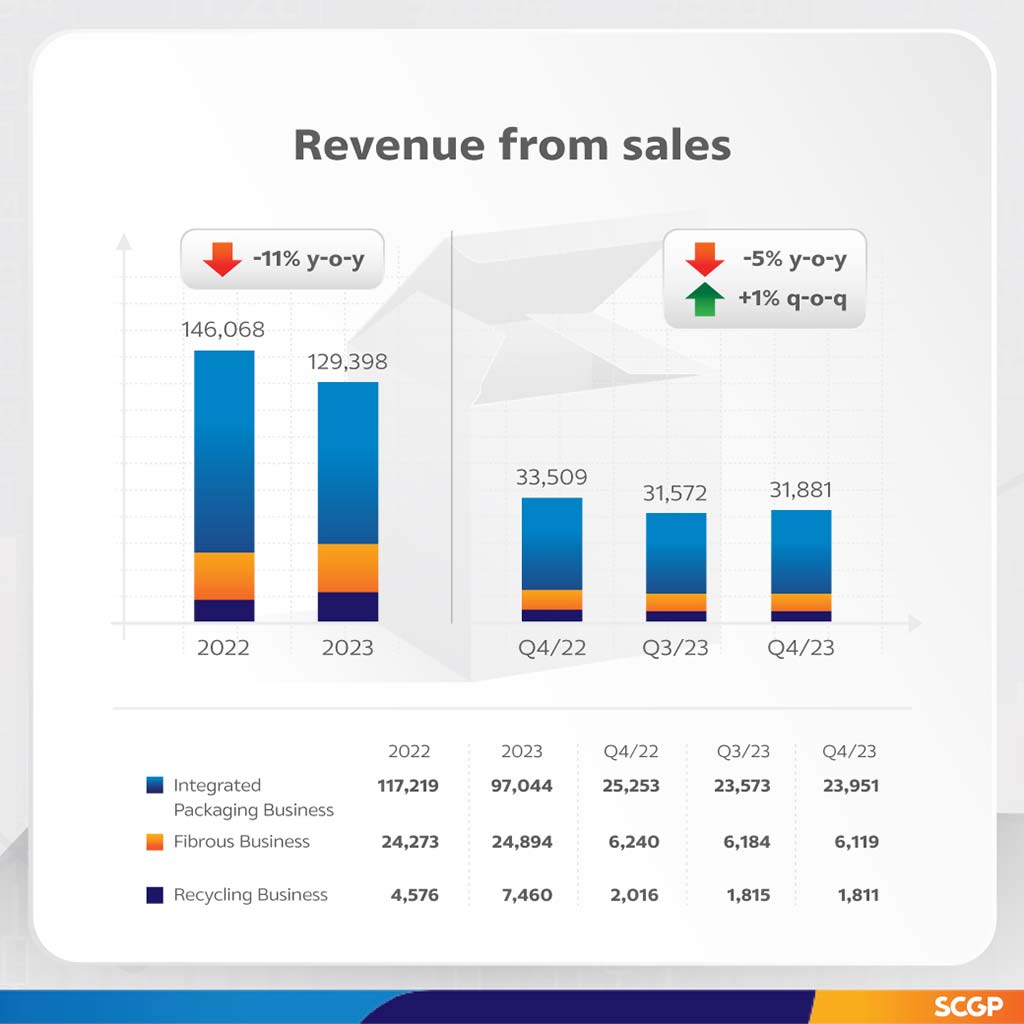

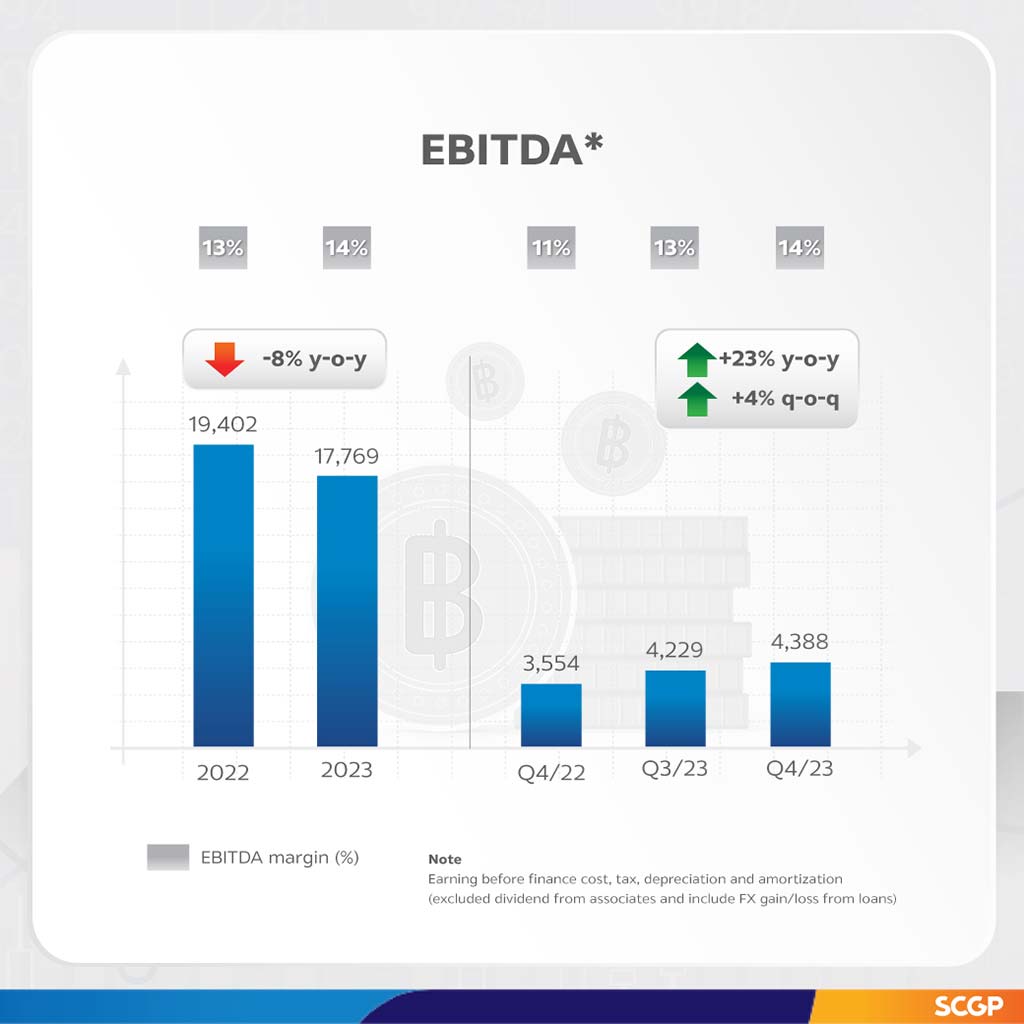

Wichan Jitpukdee, Chief Executive Officer of SCG Packaging Public Company Limited or SCGP, disclosed the company’s operating results for 2023. The revenue from sales amounted to Baht 129,398 million, a decrease of 11% YoY. EBITDA stood at Baht 17,769 million, decreased 8% YoY, and the profit for the year was Baht 5,248 million, down by 10% YoY. However, EBITDA margin increased to 14% from 13% in the previous year, reflecting the focused efforts on cost management and production efficiency improvements. Sales of consumer packaging remained strong while price competition intensified in overall packaging paper industry over the past year amid high inflation and interest rates which impacted consumer purchasing power. Nonetheless, selling prices of packaging paper and pulp in the region have already passed the bottom point and are trending upward, driven by recovering demand in ASEAN and China.

In the fourth quarter of 2023, SCGP reported revenue from sales of Baht 31,881 million, a decrease of 5% YoY but an increase of 1% QoQ. EBITDA was Baht 4,388 million, up by 23% YoY and increased by 4% QoQ. The profit for the period was Baht 1,218 million, an increase of 171% YoY but a decrease of 8% from last quarter. QoQ change in net profit was attributed to increased taxes and finance costs. The increase in EBITDA and profit from last year was driven by increased sales volumes across nearly all product groups, and enhanced cost management efficiency. These cost management strategies include the use of technology in the production process of packaging paper plants in Thailand, a comprehensive network of recovered paper sources that helps mitigate price impact and increase the stability of raw material supply, along with an increased proportion of biomass energy usage.

During the fourth quarter of 2023, packaging industry continued to recover, especially in food and beverage sectors and consumer products, which benefited from increased spending during New Year’s festivities and rising tourism activities. Notable recoveries of domestic consumption were in Vietnam and Indonesia, with exports, particularly of frozen food and pet food, showing good recovery. However, durable goods remained stable.

In consideration of the FY2023 financial performance, the Board of Directors has proposed for shareholder approval at the Annual General Meeting (AGM), a full year 2023 annual dividend payment of 0.55 Baht per share, of which 0.25 Baht per share was previously paid as an interim dividend on 22 August 2023. The final dividend payment of 0.30 Baht per share will be on 22 April 2024, record date of 3 April 2024, and XD-date of 2 April 2024.

Wichan said that the overall packaging industry is expected to continue its recovery in 2024, especially in ASEAN countries, including Thailand, Vietnam, Indonesia, and also in China. Positive factors contributing to this recovery consist of stimulus policies including in tourism and an anticipated export rebound. A downward trend in inflation rates and interest rates is expected to positively impact consumer purchasing power. Meanwhile, energy and recycled paper prices are trending toward sideway up, with potential adjustments in global freight costs from ongoing geopolitical conflict in the Middle East.

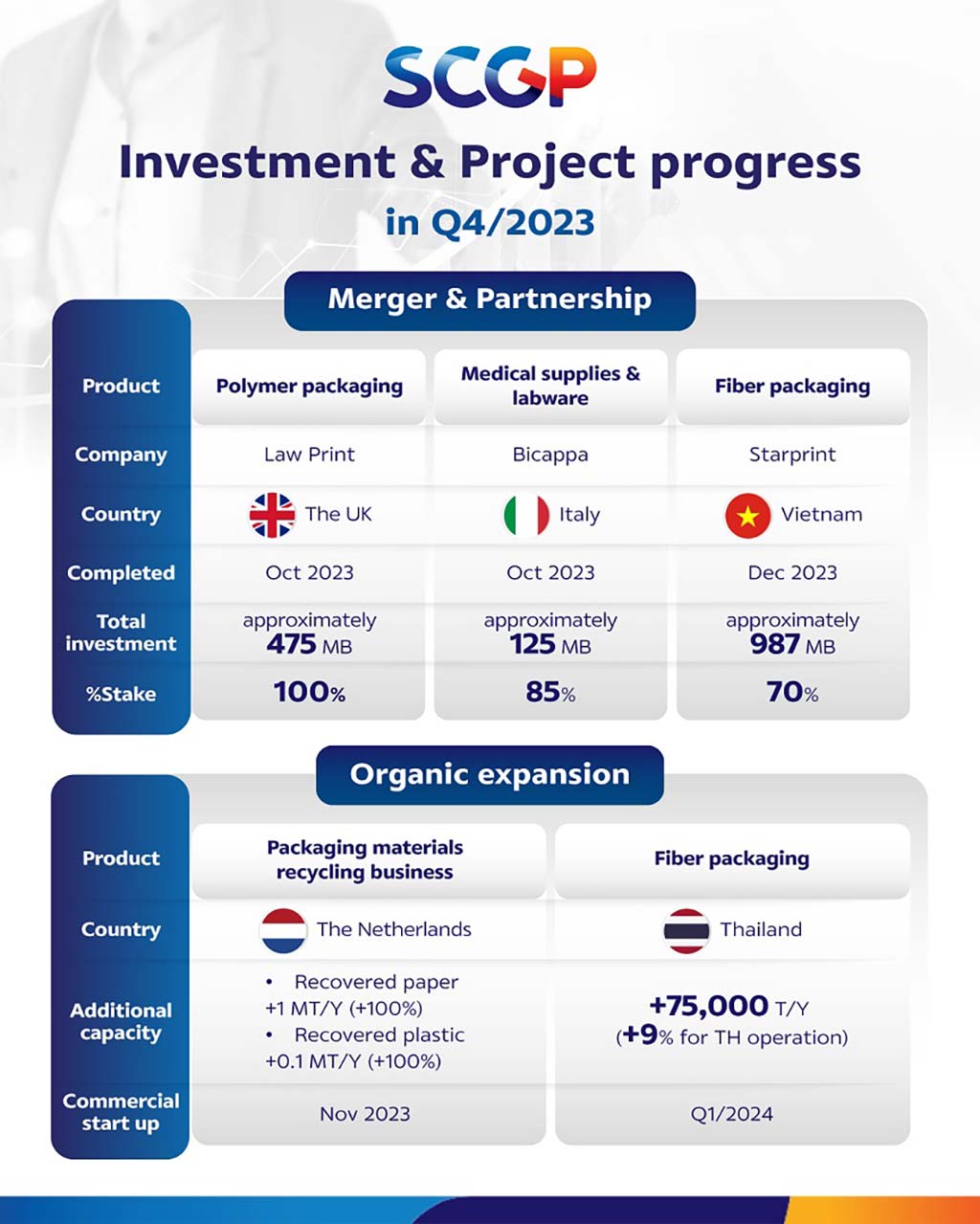

SCGP is ready to drive growth to achieve its 2024 revenue target of Baht 150,000 million, with investment budget of Baht 15,000 million. This growth will be fueled by strategies to expand the business in high-potential sectors including medical supplies and labware, global foodservice packaging, and bio-solutions, which is a megatrend. SCGP is committed to continuous developing innovation and solutions to enhance business capabilities, proactively manage costs, and elevate operational excellence through the use of technology. Moreover, ESG initiatives are in progress with the continual increase in alternative energy sources which helps move SCGP towards achieving its goal of Net Zero by 2050.

Published on: Jan 25, 2024

ดาวน์โหลดข่าว

ดาวน์โหลดข่าว