BANGKOK: 25 July 2024 – SCG announced its operating results for Q2/2024, demonstrating continuous improvement with increased sales and profit compared to the previous quarter, driven by economic recovery in Vietnam and Indonesia. SCG has enhanced business agility to navigate economic challenges, including a slow and concentrated domestic economic recovery and geopolitical conflicts. The company is increasing the use of alternative fuels, focusing on cost management, targeting high-potential businesses, leveraging AI to boost production efficiency, and offering attractive solutions to customers across ASEAN. Low Carbon Cement is being introduced to the global market, and the Vietnam petrochemical complex will resume testing operations in September.

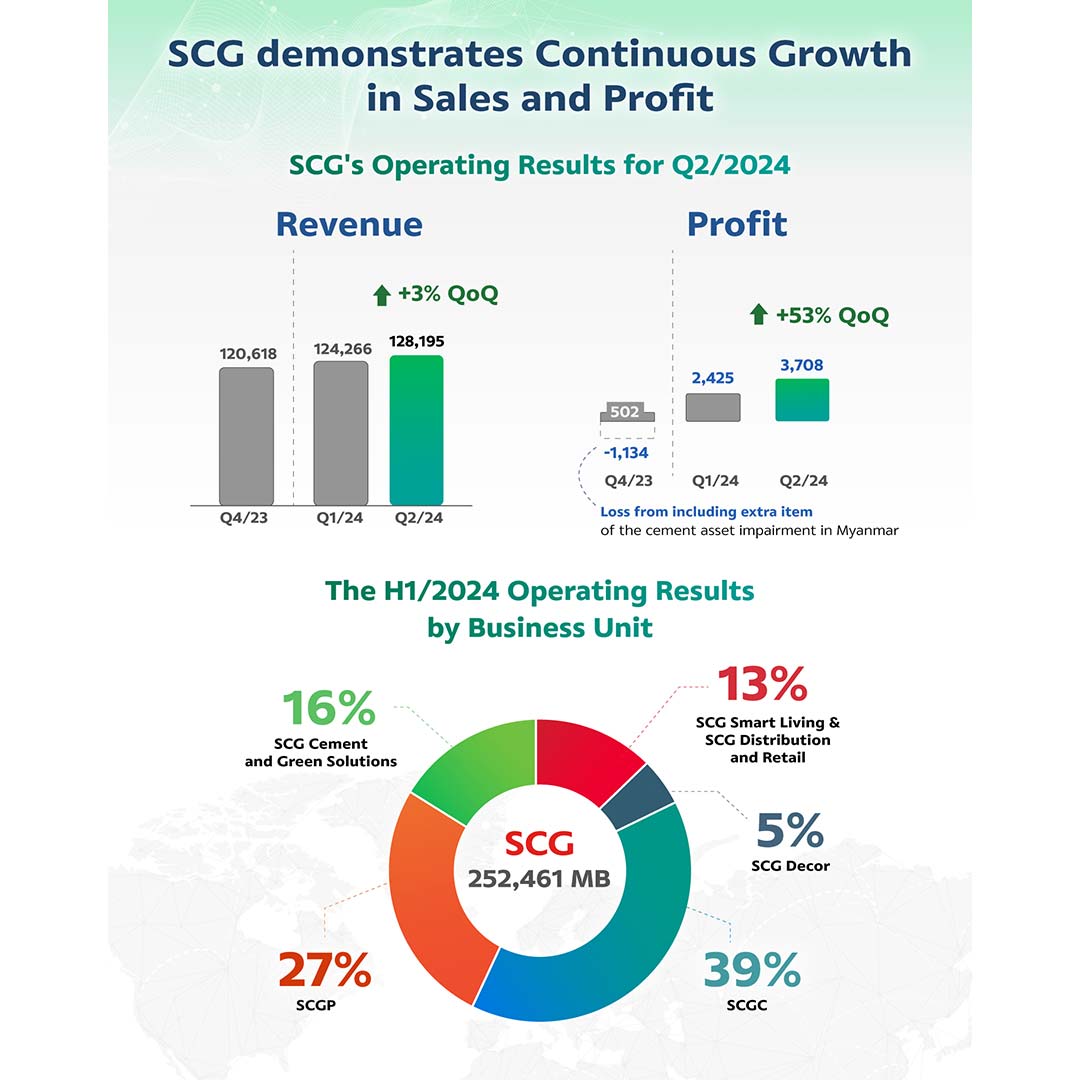

Thammasak Sethaudom, President and CEO of SCG, said, “SCG’s operating results for Q2/2024 have improved from the previous quarter due to increased sales volume from SCG Chemicals and stronger spending power in the ASEAN market, particularly in Vietnam and Indonesia. Furthermore, dividend income from SCG Investment contributed to a total revenue of 128,195 MB, an increase of 3% q-o-q, with a profit of 3,708 MB, up 53% q-o-q. For the first half of 2024, revenue was 252,461 MB, close to last year’s figure. The sales composition included 39% from SCG Chemicals, 27% from SCGP, 16% from SCG Cement and Green Solutions, 13% from SCG Smart Living & SCG Distribution and Retail, and 5% from SCG Decor.

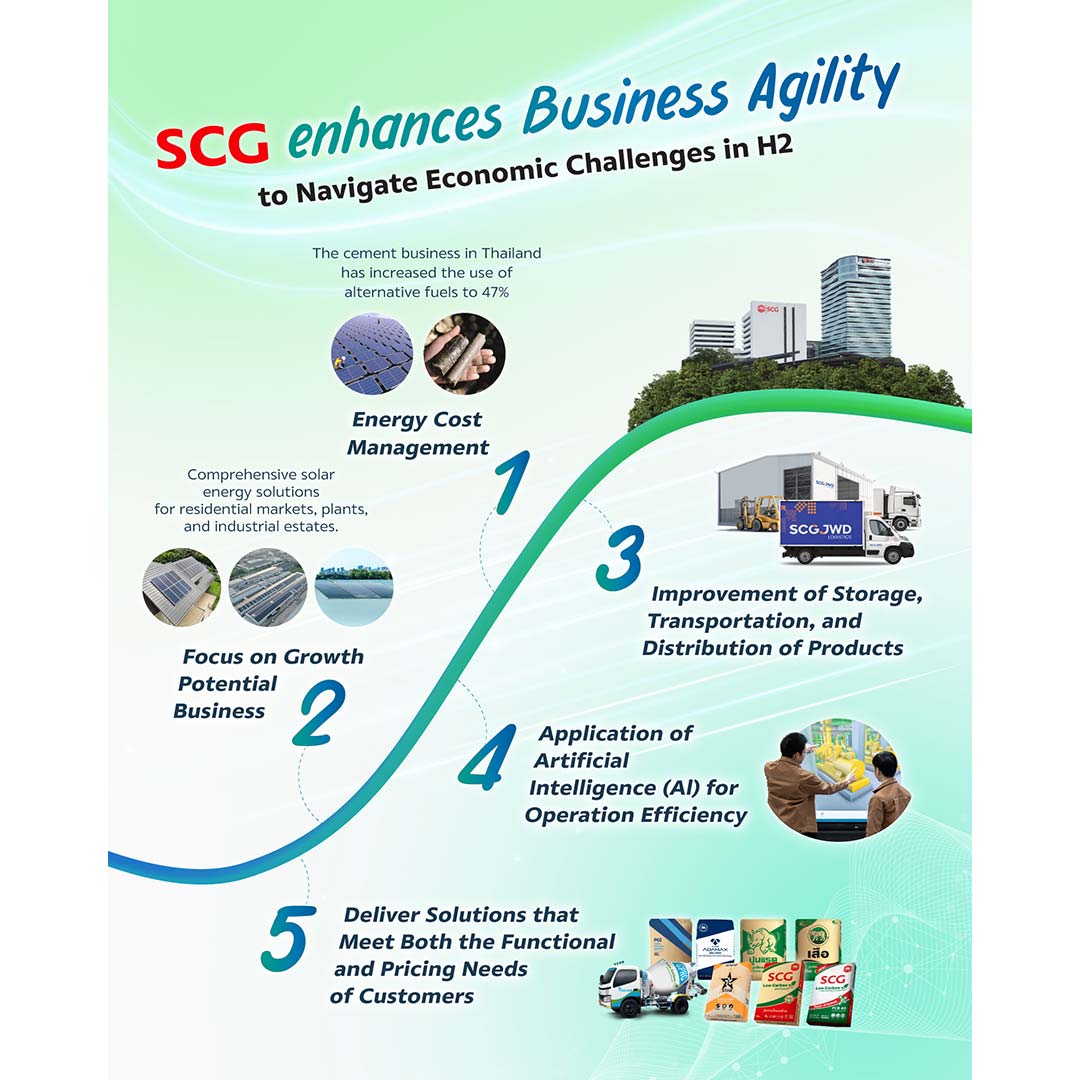

Despite SCG being impacted by the petrochemical trough and tensions from geopolitical conflicts, intense market competition from Chinese imports, and a slow domestic economic recovery due to weak spending power among the middle to low-income groups, SCG has actively enhanced its business agility and operational resilience through several strategic measures: 1.) Energy Cost Management, for example, the cement business in Thailand has increased the use of alternative fuels to 47%; 2.) Focus on Growth Potential Business, such as comprehensive solar energy solutions for residential markets, plants, and industrial estates; 3.) Improvement of Storage, Transportation, and Distribution of Products by employing technology for delivery planning and goods receipt to reduce work time, minimize damage, and reduce errors in the receipt and delivery process; 4.) Application of Artificial Intelligence (AI) for Operation Efficiency, where SCG Chemicals utilizes AI solutions from REPCO NEX to precisely manage machinery maintenance, achieving 100% reliability; and 5.) Deliver solutions that meet both the functional and pricing needs of customers, such as CPAC’s compact concrete mixer trucks, which are designed for urban construction with narrow alleys, capable of transporting up to 2 cubic meters of concrete per trip, facilitating efficient cement usage and reducing waste.”

In the first half of 2024, New Products Development (NPD) achieved sales of 38,690 MB, accounting for 20% of total sales. High-Value Added Products & Services (HVA) registered sales of 77,037 MB, constituting 39% of total sales, while SCG Green Choice, environmentally friendly products, recorded sales of 136,124 MB, representing 54% of total sales.

SCG’s revenue from operations outside of Thailand, combined with export sales from Thailand for H1/2024, registered 111,367 MB, constituting 44% of total Revenue from Sales.

For the second half of 2024, the overall economic landscape remains challenging, but SCG is prepared to respond with agility and stability. The company holds cash and cash under management totaling 78,907 MB, along with innovative solutions that meet comprehensive customer needs.

Cement and construction related businesses are benefiting from the strong economic recovery in Vietnam and Indonesia. Spending power is rebounding, driven by the Indonesian Government’s initiatives to accelerate infrastructure development and the establishment of the new capital, “Nusantara.” Additionally, the Vietnamese Government is promoting Foreign Direct Investment (FDI). In contrast, Thailand’s recovery remains sluggish due to seasonal demand declines and delayed government budget allocations.

SCG Cement and Green Solutions is accelerating the promotion of Low Carbon Cement Generation 2, which can reduce carbon dioxide emissions by 15-20% compared to conventional cement. This product is being expanded into international markets, including the United States and Australia, where it has already gained confidence in its quality, resulting in exports exceeding 1 million tons to the United States. Recently, SCG launched the first low-carbon cement in Vietnam, “SCG Low Carbon Super Cement.” In Thailand, the market continues to grow, with the usage of low-carbon cement replacing conventional cement by more than 86%. This growth is supported by increasing government construction projects. Additionally, SCG has introduced various models of cement that are of appropriate to better meet the needs of our customers, such as the “5 STAR” brand in Cambodia, “BEZT” in Indonesia, “ADAMAX” in Vietnam, and “Rad” in Thailand.

SCG Distribution and Retail is delivering home improvement products and services through more than 87 retail stores across ASEAN. In the first half of the year, the company expanded the modern trade Mitra10, a retail market expert in Indonesia which offers over 65,000 products. It added two new branches in Sumatra and West Java, regions with large populations, serving more than 1 million customers per month. The goal is to reach 100 branches by 2030. To date, 50 branches are currently operational.

SCG Smart Living is introducing landscape decorative materials, such as SCG pavement tile, to cater to tourism industry. These tiles can be custom-designed with unique patterns using a specialized shot blasting technique, like the peony pattern for sidewalks in the Chinatown area. Additionally, the brand ONNEX by SCG Smart Living has launched the Air Scrubber system, an innovative HVAC system for small spaces designed for buildings and offices with areas less than 3,500 square meters. This service will be expanded to cover ASEAN and the Middle East.

SCG Decor (SCGD) is pushing a plan to double its revenue by 2030, beginning with operational commencement of SPC LT by COTTO plant, with a production capacity of 1.8 million square meters per year, targeting revenue of 500 MB. Furthermore, another 3 main projects related to High-Value-Added and durable Glazed porcelain tiles in Vietnam and Thailand are currently under construction which expected to commercialized by this year.

Meanwhile, SCG is expanding its construction materials market to India. SCG International, in collaboration with BigBloc Construction Limited, has invested in establishing the first ‘Autoclaved Aerated Concrete (AAC) Wall’ factory, which produces lightweight wall panels, in Gujarat using the brand ‘ZMARTBUILD WALL by NXTBLOC’ for its commercial operations. Gujarat, India is a region with high and continuous growth in construction value.

SCG Chemicals (SCGC) has improved due to increased sales volume from the resumption of operations at the Rayong Olefins (ROC) plant. However, in the second half of the year, the industry remains challenging due to lower global demand and new supply additions. SCGC is accelerating the push of its green innovation, SCGC GREEN POLYMERTM, to meet high-demand markets, such as the consumer goods sector. Recently, in collaboration with Dow, SCGC developed a plastic recycling business across the entire value for the first time in the Asia-Pacific region. The goal is to develop recycling technology to convert over 200,000 tons of plastic waste per year in Southeast Asia into valuable circular products by 2030.

The Long Son Petrochemicals (LSP) project will restart and test run of both upstream and downstream operations in August-September 2024 and will begin commercial operations in October 2024.

SCGP is focusing on expanding its production capacity to meet the packaging demand from the tourism and service sectors. This includes managing raw materials and energy costs, as well as driving growth in high-potential businesses. Recently, SCGP has expanded its packaging business into medical supplies and labware by investing in VEM (Thailand) Co., Ltd., a manufacturer of high-performance polymer injection molding parts. This investment will enhance the production capabilities of Deltalab, S.L. and Bicappa Lab S.r.L., member of SCGP, to meet demand and broaden SCGP’s international customer network more comprehensively.

SCG’s new business, SCG Cleanergy, is growing well according to plan, aiming to increase the proportion of solar energy installations for high-demand industrial customers. In the first half of 2024, the total production capacity reached 522 megawatts. Recently, SCG Cleanergy partnered with Seagate Thailand, signing a power purchase agreement for a 20.96 megawatt solar rooftop at Seagate’s factory in Nakhon Ratchasima province. For the Rondo Heat Battery, which stores thermal heat from green electricity sources, the construction of the world’s first unit for the cement industry is underway at the SCG cement plant in Saraburi province. This unit is expected to begin operations in 2025 and will serve as a model for other industries.

Thammasak concluded, “SCG recognizes the economic situation that affects the livelihoods on a wide scale. Therefore, in collaboration with the Federation of Thai Industries, Saraburi Chapter, SCG has launched the Go Together project to educate and build networks among SME entrepreneurs, starting with the Saraburi plant and expanding to other provinces where SCG has plants, such as Kanchanaburi, Lampang, Khon Kaen, and Nakhon Si Thammarat. This project aims to enhance competitiveness by improving and integrating technology into production processes, reducing costs, and repurposing waste into useful materials and fuels. Additionally, it promotes the use of clean energy to reduce greenhouse gas emissions. Meanwhile, the SCG Foundation is promoting the LEARN to EARN concept, focusing on learning for employment. The foundation grants approximately 3,000 scholarships per year to children and youth, both in and out of the formal education system, in fields that meet market demands, such as nursing assistants and dental assistants, with over 90% securing employment.”

In addition, the Board of Directors of SCG has approved the H1/2024 interim dividend payment of 2.50 Baht per share (3,000 MB), which is payable on August 23, 2024, with the XD-date on August 7, 2024, and the record date on August 8, 2024.

Key Financial Information of SCG

SCG’s operating results for Q2/2024 registered the Revenue from Sales at 128,195 MB, an increase of 3% q-o-q, driven by higher sales volumes from SCG Chemicals. The Profit for the Period was 3,708 MB, an increase of 53% q-o-q, attributed to dividend income from SCG Investment. Compared to the same period last year, the Revenue from Sales increased by 3%, driven by sales from SCG Chemicals and SCGP. However, the Profit for the Period decreased by 54%, and the Profit excluding extra items decreased by 29%, due to lower chemicals spreads and the Long Son Petrochemicals project expenses.

For H1/2024, SCG reported Revenue from Sales of 252,461 MB, which was similar to the previous year, due to a decline in sales from businesses related to cement and construction, affected by weak market conditions in Thailand, despite an increase in sales from SCG Chemicals and SCGP. The Profit for the Period was 6,133 MB, a decrease of 75% y-o-y, due to fair value adjustments of investments in H1/2023 amounting to 14,822 MB. The Profit excluding extra items decreased by 37% y-o-y due to lower chemicals spreads and the Long Son Petrochemicals project expenses.

SCG’s total assets as of June 30, 2024, amounted to 949,478 MB, of which 46% represented assets in ASEAN (excluding Thailand).

The Q2/2024 and H1/2024 operating results by business units are as follows:

- SCG Chemicals (SCGC): For Q2/2024, SCGC recorded Revenue from Sales of 52,491 MB, an increase of 16% q-o-q and an increase of 8% y-o-y due to increased sales volumes. Loss for the Period was 1,241 MB, an improvement of 33% q-o-q, but a higher loss compared to the same period last year by 1,982 MB. This was mainly due to the recognition of expenses from the Long Son Petrochemicals project and the recognition of a loss from inventory valuation adjustments of 363 MB. For H1/2024, SCGC reported Revenue from Sales of 97,867 MB, an increase of 2% y-o-y. Loss for the Period was 3,107 MB, a decrease of 5,204 MB compared to the same period last year, due to lower selling price spreads and the Long Son Petrochemicals project expenses.

- SCG Cement and Green Solutions: For Q2/2024, SCG Cement and Green Solutions reported Revenue from Sales of 19,831 MB, a decrease of 7% q-o-q and y-o-y. Profit for the Period was 774 MB, a decrease of 35% q-o-q but was flat y-o-y. This amid the overall decline in domestic market of grey cement demand in Thailand, which resulted from delayed government budget disbursements and softer demand from the low to medium segment residential and private sectors. For H1/2024, the business reported Revenue from Sales of 41,230 MB, a decrease of 7% y-o-y. Profit for the Period was 1,965 MB, an increase of 24% y-o-y, due to effective cost management.

- SCG Smart Living & SCG Distribution and Retail: For Q2/2024, SCG Smart Living & SCG Distribution and Retail recorded Revenue from Sales of 35,266 MB, a decrease of 8% q-o-q and 5% y-o-y. The Profit for the Period was 576 MB, similar to the previous quarter but an increase of 81% y-o-y, amidst a contraction in the construction product market due to increased household debt and stringent bank lending. For H1/2024, Revenue from Sales was 73,668 MB, a decrease of 4% y-o-y. The Profit for the Period was 1,158 MB, an increase of 62% y-o-y.

- SCG Decor (SCGD): For H1/2024, SCGD reported Revenue from Sales of 13,350 MB, a decrease of 7% y-o-y. The Profit for the Period was 541 MB, an increase of 167% y-o-y.

- SCGP: For H1/2024, SCGP recorded Revenue from Sales of 68,182 MB, an increase of 3% y-o-y. The Profit for the Period was 3,178 MB, an increase of 17% y-o-y.

Published on: Jul 25, 2024