Bangkok: July 27, 2022 – SCG’s Q2/2022 operating results show continuous revenue growth despite energy costs’ effects on profits, maintaining robust financial standing and paying 6 Baht/share dividend with XD-date on August 10th. Deploying 5 strategies to tackle the global economic crisis including 1.) tightening expenses, lowering costs, increasingly use of biomass and solar energy, 2.) consistently push for innovative products and services, 3.) increasing financial liquidity, 4.) Reassessing and carefully prioritizing strategic investments such as LSP (96% progress) and acquiring a major packaging material recycling operator in the Netherlands; and 5.) accelerating ESG with eco-friendly innovations, continuing occupational development programs to help reduce inequality and creating stable income.

Mr. Roongrote Rangsiyopash, President & CEO, SCG discloses that “Despite volatile situations with crisis upon crisis such as inflation, rising interest rates, increased energy and raw material costs as well as climate change, SCG continues to adapt, resulting in strong overall business and financial performances. Innovative product and service developments are in full gear, especially eco-friendly items with SCG Green Choice labels and innovations to meet consumers’ demands for safety and convenience, catering to the tourism and service sector’s recovery as borders fully open. Moreover, strategical investments are being prioritized, resulting in the delay of new projects that are unurgent while still going through with quick-return projects and ones that are aligned with the company’s long-term growth plans. This includes the LSP petrochemical complex project in Vietnam and SCGP’s acquisition of Peute, the largest packaging material recycling business in the Netherlands.

The Company’s unreviewed Operating Results for Q2/2022 registered Revenue from Sales of 152,534 MB, a flat q-o-q and an increase 14% y-o-y mainly due to higher sales across all businesses from higher product prices in-line with market prices. Profit for the Period is 9,937 MB, a decrease 42% y-o-y from rising feedstock costs in the Chemicals business following global oil prices as well as lower equity income at Chemicals business. Profit for the Period registered an increase 12% q-o-q due to dividend income from the investments business.

SCG’s Revenue from Sales for the first half of 2022 rose 19% y-o-y to 305,028 MB. Profit for the Period registered 18,781 MB, a 41% decrease y-o-y attributed to increased feedstock costs in the Chemical business following increased global oil prices and lower equity income from associates. Moreover, during H1/2021, severe winter climates in the United States decreased the world’s production capacity, causing petrochemical industry performance to be abnormally high.

SCG’s Revenue from Sales of High–Value Added Products & Services (HVA) for H1/2022 reached 104,332 MB or 34% of total Revenue from Sales. New Products Development (NPD) and Service Solution such as SCG Hybrid Cement and Hygienic Tiles, made up 17% and 5% of total Revenue from Sales respectively.

SCG’s Revenue from operations outside of Thailand together with export sales from Thailand for H1/2022 registered 135,822 MB. This constituted 45% of total Revenue from Sales, an increase of 1% y-o-y.

The total assets of SCG, as of June 30, 2022, amounted to 903,137 MB, of which 45% represented assets in ASEAN (excluding Thailand).

The Q2 and H1 of 2022 operating results by business units are as follows:

Chemicals Business or SCGC recorded Q2/2022 Revenue from Sales of 66,789 MB, down 3% q-o-q while up 10% y-o-y due to higher product prices while decreased sales volume. Profit for the Period totaled 3,704 MB, increased 3% q-o-q while decreased 64% y-o-y from rising feedstock costs.

The H1/2022’s Revenue from Sales of SCGC reached 135,951 MB, increased 21% y-o-y due to higher product prices. Profit for the Period was 7,292 MB, decreased 62% y-o-y due to rising feedstock costs and lower equity income from associates.

Cement–Building Materials Business recorded Q2/2022 Revenue from Sales of 52,881 MB, an increase of 14% y-o-y thanks to the sales strategies which increased revenue both in Thailand and the region. This compensated for stagnant product demand which affected this quarter’s revenue. Profit for the Period was 1,668 MB, a decrease of 32% y-o-y mainly from higher energy and raw material costs, and a decrease 28% q-o-q.

The H1/2022’s Revenue from Sales of Cement-Building Materials Business reached 103,771 MB, increased 12% y-o-y. Profit for the Period decreased 25% y-o-y to 3,976 MB.

SCGP recorded Q2/2022 Revenue from Sales of 37,982 MB, an increase of 27% y-o-y and 4% q-o-q mainly attributed to the growth of the integrated packaging business in customer segments of consumer-linked products, especially in Vietnam. Contributions also include commercial start-up of new packaging paper production line in the Philippines (UPPC 3), price adjustments to reflect continuously rising costs as well as growth in the fibrous business from increases in both pulp prices and the improved demand of foodservice packaging and paper. Profit for the Period registered 1,856 MB, a drop of 18% y-o-y but increased 12% q-o-q.

The H1/2022’s Revenue from Sales of SCGP reached 74,616 MB or increased 31% y-o-y. This is mainly due to continuous business growth across all businesses, coupled with the consolidation of financial performance of Duy Tan, Intan Group, and Deltalab as well as product price adjustment related to rising costs and the increased demand for fiber packaging and foodservice packaging. Profit for the Period decreased 20% y-o-y to 3,514 MB.”

Mr. Roongrote further elaborates that “at present, the global economy is highly unpredictable. SCG closely monitors the situation and aligns its operations with 5 strategies consisting of 1.) reducing costs and increasing alternative energy, 2.) continuously developing High Value Added Products & Services (HVA), 3.) expanding financial liquidity, 4.) prudent strategic investments; and 5.) emphasizing ESG with ESG 4 Plus guidelines:

1.) Reducing costs and increasing alternative energy by adopting efficient manufacturing technologies, reducing waste, and increasing the proportion of alternative energy such as biomass and solar power. At present, SCG’s alternative energy consumption stands at 16.4%.

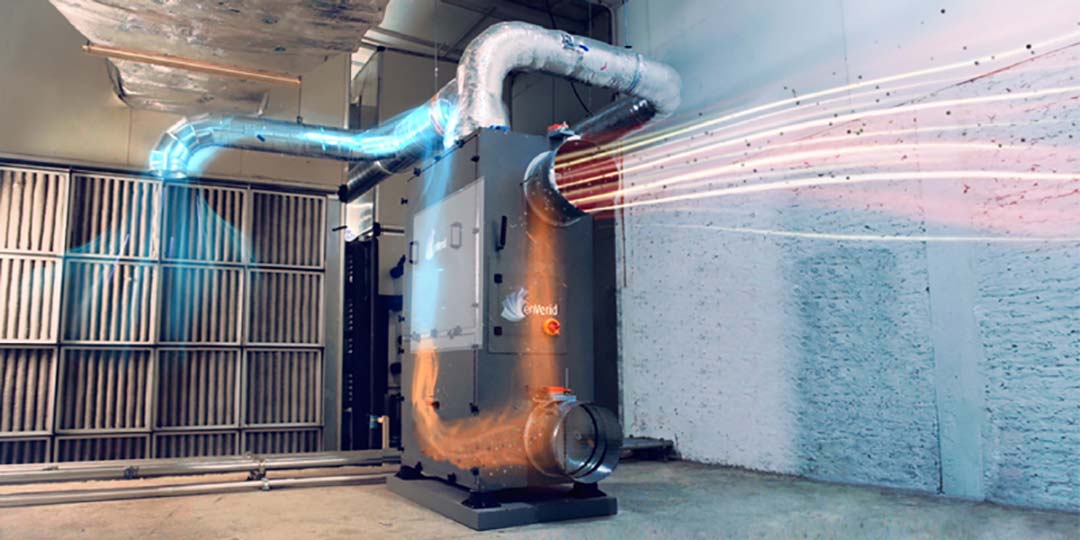

2.) Continuously developing High Value Added Products & Services (HVA) while seeking new markets to create distinctiveness and increase competitiveness. Examples of chemical innovations include high-quality odorless PCR for eco-friendly packaging, especially those that require fragrance, and barrier coating technology that substitutes multi-material packaging with mono-material to ease the recycling process. Examples of better living innovations are SCG HVAC Air Scrubber, an air treatment system that reduces cooling load in buildings and saves 20-30% on electricity expenses, anti-bacteria tiles, touchless faucets and sanitary wares, and Ultraclean+ coated sanitary wares by COTTO Health & Clean that help curb bacterial accumulation. Examples of construction innovations under the CPAC Green Solution brand use technology to enhance construction solutions such as farm solution, a one-stop farm design and construction service with quick completion and bio-security standards, as well as gas station solution, a one-stop gas station design and construction service. An example of packaging innovation is Fest Chill food packaging from paper, coated with peelable films for convenience in recycling and degradable with durable designs suited for food delivery services.

3.) Expanding financial liquidity with proper working capital management, inventory level that reflect markets demand, and trade credits that are closely monitored. Additionally, SCGP digital bonds are to be issued on August 1, 2022.

4.) Prudent strategic investments, revisiting investment plans, delaying new, unurgent projects or those that require longer runway to generate returns, and targeting quick-return projects that are aligned with SCG’s growth strategy. Examples are the Long Son Petrochemicals Company Limited (LSP) in Vietnam which is progressing as planned with 96% completion and is expected to begin commercial operations by H1/2023. Recently, SCGP expanded into the packaging materials recycling business with Peute Recycling B.V., Netherlands’ largest packaging materials recycler, and invested in USA’s Imprint Energy Inc. in the printed battery business. Imprint has solid growth potential while its know-how and expertise can be be applied in ASEAN and used for smart packaging.

5.) Emphasizing ESG with ESG 4 Plus guidelines (Set net-zero – Go green – Reduce inequality – Embrace collaboration, PLUS trust through transparency in all operations). In H1/2022, sales of eco-friendly innovations under the SCG Green Choice label amount to 153,240 MB, 50% of the total Revenue from Sales.

SCG focuses on reducing inequality for those affected by the economic crisis. In H1/2022, the projects welcomed 4,366 participants in all 3 facets addressed. Firstly, creating sustainable income such as knowledge development to add value to community products, career development for the disabled, home renovation skills development, and in-demand skills development for young generations. Secondly, enhancing skills for job stability such as for contractors. And expanding work opportunities such as allowing credits for contractors to facilitate the purchasing of construction materials by Siam Saison.

Recently, SCG organized the ESG Symposium 2022 which welcomed over 130,000 on-site and online participants and collaborations from 315 coalitions across sectors to relieve the earth’s crises and reduce inequality. The event expanded brainstormed ideas to implementation with guidelines to establish collaborations for innovation towards net-zero. This contributes to timely development of a roadmap for the best carbon emissions reduction innovation for use in Thailand. Also, plans were underway for collaborations toward a low-carbon society with 60 private organizations that extend across alternative energy, circular economy, sustainable consumption, and enhancing women and youth’s roles in driving the economy and resolving crises together.

Besides, SCG collaborated with the Thai Cement Manufacturers Association (TCMA), Thailand Concrete Association (TCA), and Global Cement and Concrete Association (GCCA) to establish the “Thailand Chapter: Net Zero Cement & Concrete Roadmap” which was presented at the GCCA CEO Gathering 2022 in Atlanta, USA. This was done to help drive CO2 emission reduction in cement and concrete businesses worldwide.

In addition, The Board of Directors of SCG has approved H1/2022 interim dividend payment of 6.0 Baht per share (7,200 MB), which is payable on Friday, August 26, 2022, with XD-date on Wednesday, August 10, 2022, and record date on Thursday, August 11, 2022.” Mr. Roongrote concluded.

Published on: Jul 27, 2022

ดาวน์โหลดข่าว

ดาวน์โหลดข่าว