July 31, 2025 – Bangkok: SCG has announced continued improvement in its operating results for the first half of 2025, with a stronger EBITDA of 30,320 MB. Net debt declined by nearly 10,000 MB, driven by ongoing adjustments across all business units, including investment portfolio restructuring and the discontinuation of unprofitable businesses. Looking ahead, SCG anticipates that the economic landscape in Thailand, ASEAN, and globally will remain highly challenging in the second half of 2025 due to factors such as U.S. tariffs, geopolitical conflicts, and volatile energy prices. The company is accelerating its business operations through regional optimization across its production bases in ASEAN, cost reduction to boost business competitiveness, and expanding Smart Value, HVA, and Green Products to tap into growth markets. Additionally, an interim dividend of 2.50 Baht per share has been approved, demonstrating the company’s continued commitment to its shareholders.

Thammasak Sethaudom, President and CEO of SCG, said, “SCG has consistently implemented measures to strengthen its financial position since mid-2024. This has resulted in a stronger EBITDA for the first half of 2025, which stands at 30,320 MB, an increase of 21% from the second half of 2024. This improvement is attributed to investment portfolio adjustments, the discontinuation of unprofitable businesses, and management initiatives to enhance operational efficiency across all units. Specifically, the Cement and Building Materials business has managed costs effectively; the Packaging business (SCGP) has successfully optimized production planning, effective cost management of recovered paper, and the use of technology and AI to enhance cost efficiency; while the Chemicals business (SCGC) has shown a gradual recovery. The chemical product price spread (Gap) has begun to improve slightly due to declining crude oil costs. In addition, SCG continues to receive recurring dividend income.

In Q2/2025, working capital was efficiently managed, decreasing by 7,164 MB compared to Q1/2025. Net debt declined by 8,365 MB from the end of Q1/2025. Cash on hand at the end of Q2/2025 stood at 45,542 MB.

For its H1/2025 operating results, SCG reported revenue of 249,077 MB and a net profit of 18,436 MB. Excluding extra items related to business restructuring, the profit amounted to 3,266 MB.

Key operational highlights for the first half of 2025 include:

- Reducing costs to compete with global manufacturers. For example, SCGC optimized raw material costs and enhanced the value of by-products, resulting in cost savings and value creation of 912 MB. The company also improved plant operations to maximize efficiency, achieving additional cost savings of 616 MB, and reduced working capital by 6,989 MB. SCG Cement and Green Solutions utilized eco-friendly and alternative energy sources in production processes, lowering costs by 1,100 MB. SCG Decor increased usage of clean energy, negotiated for lower raw material costs, and efficiently managed inventory — resulting in total cost savings of over 146 MB per year. SCG Smart Living implements robotics and clean energy in production process, saving 105 MB in costs.

- Operational and business restructuring efforts. For example, PT Chandra Asri Pacific Tbk. (CAP) in Indonesia and some SCGC operations in Europe, and some businesses under SCG Smart Living in Indonesia helped reduce costs and expenses by over 15,170 MB in Q2/2025.

- Expansion of the product portfolio to meet demand across all market segments. For example, SCGC developed High Value Added Products (HVA) to serve key sectors, including infrastructure, consumer packaging, automotive, medical and healthcare, and energy solutions. SCG Decor has expanded its product portfolio from decorative surface and bathroom to import of complementary products such as tire adhesive and grout, doors and windows, and kitchen worktops. It is also tapping into high-value segments with HVA products such as glazed porcelain tile and smart sanitary ware.

However, SCG views the outlook for the second half of 2025 as highly challenging, with the economies of Thailand, ASEAN, and the world affected by U.S. tariffs, geopolitical conflicts, and volatile energy prices. Therefore, SCG is accelerating efforts to enhance its business competitiveness to address these challenges, which include:

1.) Leveraging Diverse Production Bases in “ASEAN” (Regional Optimization). This is a key strength and competitive advantage for SCG. The strategy focuses on manufacturing in and exporting from Vietnam to capitalize on a favorable U.S. import tariff rate of 20% and competitive costs. This is combined with Vietnam being a domestic consumption base with high growth potential. For instance, SCGC plans to resume operations at the Long Son Petrochemicals (LSP) plant in Vietnam in late August 2025. Meanwhile, the project to enhance LSP’s competitiveness using ethane feedstock is progressing as planned, with completion expected in 2027. SCG Cement and Green Solutions is expanding its Low Carbon Cement production base in South Vietnam. With a maximum capacity of 8,000 tons per day, the facility will serve the domestic Vietnamese market and support exports to the United States, Canada, Australia and Oceania. SCG Decor increased production capacity of glazed porcelain tile in Vietnam to serve the growing market demand and reduced production cost to match those of world-class player. SCGP continues to strengthen its integrated packaging business in Vietnam, which covers the entire value chain from packaging paper production to paper packaging, polymer packaging, and foodservice packaging.

Furthermore, SCG is actively seeking opportunities in other high-potential markets. Examples include: In Africa, SCG Distribution and Retail expanded its “cement clinker” market. In Asia, the “3D Printing Solution” market has expanded rapidly, with a strategic shift to selling 3D Printing Mortar, enabling market entry into Japan, Saudi Arabia, and Malaysia for faster and waste-free building. In Oceania, SCG Smart Living has expanded “roofing and ceiling” products to Australia and New Zealand markets by selecting products tailored to meet the specific needs and usage requirements of each market. SCG Cement and Green Solutions also expanded the market for SCG “Low Carbon Cement Gen 1 and Gen 2”, which have been certified under the new Thai Industrial Standard 2594-2567 and awarded an Environmental Product Declaration (EPD) in North America, becoming the first Thai brand to achieve this. It is preparing to launch “SCG Low Carbon Cement Gen 3” as the first in the market and is currently conducting pilot projects with more than 15 sites. In Europe, SCG Decor has expanded the market for “glazed porcelain tiles” to Czech Republic, and SCGP has optimized “foodservice packaging production” for cost competitiveness.

2.) “Reducing costs” to Compete with Global Manufacturers

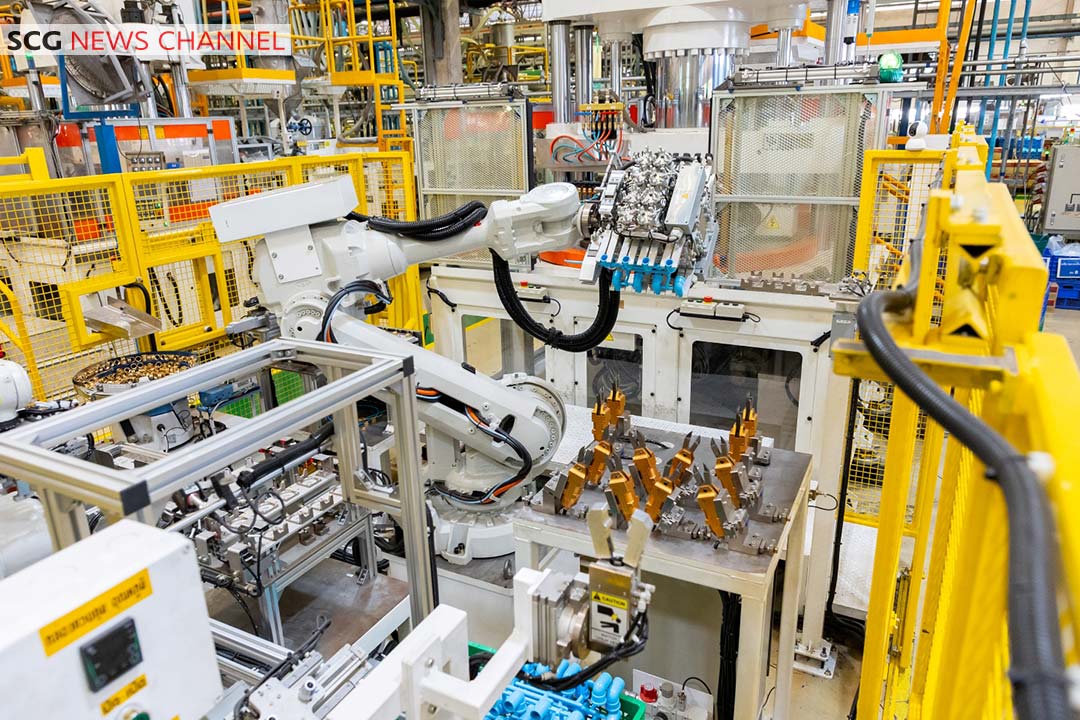

- The use of robotics and AI: For instance, SCG Cement and Green Solutions employ robotic systems to automate the packing of cement bags and their dispatch to the warehouse. Additionally, the company utilizes an Automated Storage and Retrieval System (AS/RS) to efficiently organize products for loading onto transport vehicles. In collaboration with strategic partners, SCG is also pioneering the development of Thailand’s first autonomous electric mining truck. SCG Smart Living has implemented automation systems in the production of roof tiles, ridge caps, and SmartBOARD wall and ceiling panels, resulting in standardized product quality, reduced production waste, and lower management costs. Furthermore, the company has commenced the adoption of AI technologies to enhance efficiency in the design and development of new products. SCG Decor engages automated systems to move tiles and sanitary ware during production process including applies AI to assist in product design, simulate processes before actual production, perform quality inspections, and manage its warehouse. SCGC uses robotics to manage its plant, such as at Nawaplastic Industries which produces PVC pipes, fittings, and finished PVC products, at a robot density ratio comparable to the global best-in-class level. And it also utilizes digital technology and AI to shorten polymer development and further enhance production efficiency.

- Reducing administrative costs by centralizing production from redundant plant operations.

3.) Expanding “Smart Value – HVA – Green Products” to Penetrate High-Growth Markets

- Smart Value Products (SVP) that meet consumer needs in the current economic climate. Examples include: “ADAMAX Cement” in Vietnam, “5 Star Cement” in Cambodia, and “Bezt Cement” in Indonesia by SCG Cement and Green Solutions. “SCG Ceramic Roof Tile – Celica Curve” by SCG Smart Living, and “SOSUCO tile and bathroom” by SCG Decor.

- High Value Added Products (HVA) and service solutions. Examples include: “CHILLOX,” an energy-saving solution for cold storage warehouses that maintains stable temperatures, reduces electricity consumption, and retains coldness during emergencies. This solution uses by-products from the polyolefins plant to create new business opportunities; and “DRS” (Digital Reliability Service Solutions), the world’s first fully integrated digital service solutions for industrial sectors, by SCGC; “High-strength concrete manhole covers for underground electrical conduit systems,” utilizing ultra-high performance concrete technology to enhance durability and reduce accidents and noise caused by passing vehicles; and the first-in-Thailand “ready-mixed mortar specifically designed for corners,” enabling the construction of smooth, straight, and precisely angled edges by SCG Cement and Green Solutions; “ONNEX ArcBox”, an innovative fire-prevention device for solar panel systems utilizing advanced technology from the UK and “SCG SmartBOARD Zuper – wall panels”, which have been enhanced for greater strength and flexibility by SCG Smart Living; “RAYCOOOL” is an exterior building film, which uses Radiative Cooling technology to reflect heat radiation away from the building, making interiors cooler and reducing energy consumption more effectively compared to conventional films, by SCG Distribution and Retail; “Klirr” model automatic sanitary ware; “Standard Click Lock” surface material for fast installation, waterproof, and termite-proof; and “X STRONG” tiles, which are extra scratch-resistant and load-bearing, and release positive ions to eliminate bacteria, by SCG Decor.

- Green Products. Examples include the first-in-Thailand “WINDSOR” low-carbon vinyl doors and windows by SCGC, and “DECAAR by SCG – COMFORT” concrete paving tiles, featuring exclusive HeatSync technology for superior heat reflection and rapid heat release by SCG Smart Living.

Thammasak concluded, “Although the trade war situation remains uncertain, SCG is confident that our clear strategy, rapid and agile adaptation, and the dedication of our teams across all business units will enable us to maintain the organization’s financial strength and competitiveness. Furthermore, collaboration with partners across the entire business ecosystem remains at the heart of sustainable growth. Therefore, SCG continues to collaborate with various sectors on projects such as the ‘NZAP: Net Zero Accelerator Program’ and ‘Go Together,’ organizing the Leadership Forum under the ‘ESG Symposium,’ to be held between August and October 2025. This forum will bring together world-class organizations such as the United Nations Development Coordination Office (DCO) and the Massachusetts Institute of Technology (MIT), along with leading Thai institutions such as the Bank of Thailand, the Thailand Development Research Institute (TDRI), and the Federation of Thai SME to jointly develop approaches to enhance business competitiveness and to drive the restructuring of the Thai economy toward a low-carbon society (Green Transition), ensuring Thailand’s readiness to compete globally amid challenges.”

In addition, the Board of Directors has approved the H1/2025 interim dividend payment of 2.50 Baht per share, totaling 3,000 MB, to continuously care for shareholders. The dividend is payable on August 28, 2025, with the XD-date on August 13, 2025, and the record date on August 14, 2025.

Published on: Jul 31, 2025